Sustainability mission statement

BENDURA Funds Inc. (BFLI) is a provider of private label funds. A private label fund is a tailored fund that is designed according to the preferences of a fund initiator. BFLI does not provide own inhouse funds, therefore the characteristics of all funds depend on wishes of an external initiator. Even more importantly, for certain funds, BFLI has delegated portfolio management to a third party and hence the investment decision is not in the hand of BFLI.

However, environmental and social sustainability is important to us since protecting the environment implies protecting human beings. As a private label fund provider, we encourage the fund initiators and asset managers to act responsibly and to design sustainable fund solution. We classify all our fund solutions according to three types of products, namely dark green, light green, and grey products. This should help investors to pick a fund according to their sustainability preferences.

| Classification | Green | Light green | Grey |

| Explanation | financial product has sustainable investment as its objective (Art. 9 REGULATION (EU) 2019/2088) | product promotes, among other characteristics, environmental or social characteristics (Art. 8 REGULATION (EU) 2019/2088) | Environmental and social sustainability is no target of the fund |

| Fund solutions | MIKRO KAPITAL FUND A | PRIVILÈGE Capital Fund III |

What is considered by BFLI to be sustainable? |

| In general, BFLI is guided by the 17 Sustainable Development Goals (SDGs) set by the United Nations. Sustainability is thus understood as the fulfilment of the 17 SDGs. |

Sustainable investment |

For the purposes of sustainability related product disclosures, we are guided by the relevant REGULATION (EU) 2019/2088 that defines sustainable investment: An investment in an economic activity that contributes to an environmental objective, as measured, for example, by key resource efficiency indicators on the use of energy, renewable energy, raw materials, water and land, on the production of waste, and greenhouse gas emissions, or on its impact on biodiversity and the circular economy, or an investment in an economic activity that contributes to a social objective, in particular an investment that contributes to tackling inequality or that fosters social cohesion, social integration and labour relations, or an investment in human capital or economically or socially disadvantaged communities, provided that such investments do not significantly harm any of those objectives and that the investee companies follow good governance practices, in particular with respect to sound management structures, employee relations, remuneration of staff and tax compliance; |

Sustainabilitly factors |

| Sustainability factors play a vital role for the assessment of the sustainability of an investment. Sustainability factors mean environmental, social and employee matters, respect for human rights, anti‐corruption and anti‐bribery matters. |

Measuring sustainability |

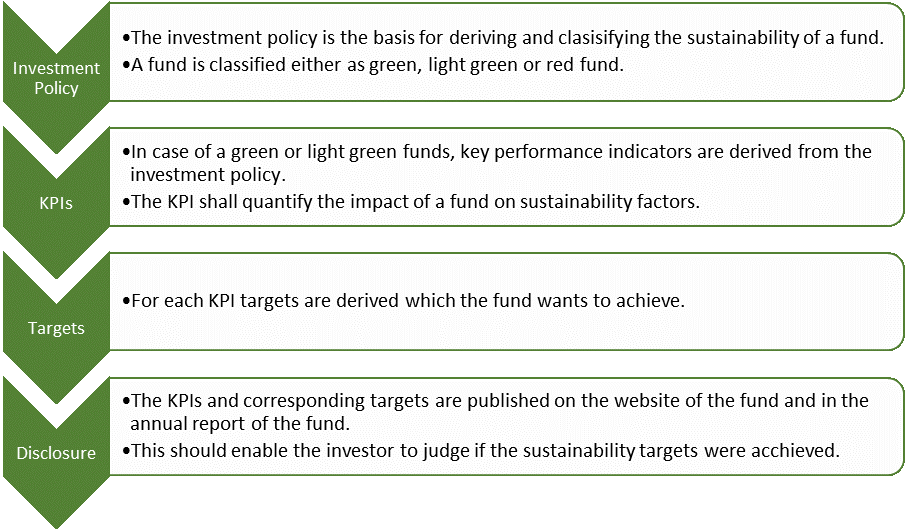

| On the basis of the investment policy of a fund, we derive key performance indicators for sustainability factors and define targets (i.e. a specific realization of the key performance indicator) which we want to reach with the fund. The key performance indicators and the targets are published on the website information of the specific fund. In the annual report of the fund and on the website, we compare the target and the realization of the KPI which shall give the investor an indication in how well we reached our goals. |

No consideration of sustainability adverse impacts

BFLI does not consider sustainability adverse impacts on the fund managing company level. However, BFLI does consider for selected funds the adverse impacts of its investment decisions on sustainability factors. Please note, for BFLI it is neither a goal nor feasible to consider for all managed funds the adverse impacts of its investment decisions on sustainability factors since

- BFLI is not in charge for making investment decisions for all funds being managed by BFLI and

- several fund types are not suited for the consideration of sustainability adverse impacts. For example, funds being designed for structuring of complex company circumstances, inheritance and succession planning or protection against hostile takeovers have no sustainable feature.

An aggregation of sustainability adverse impacts across this very different fund types brings no benefit for investors, especially since many of these fund types are not open for subscription for external investors. As a consequence, BFLI does not consider sustainability adverse impacts on entity level.

BFLI plans to consider adverse impacts of its investment decisions on sustainability factors for the following funds.

| Fund | Consideration of adverse impacts on investment decisions | Principal adverse sustainability impacts statement |

| MIKRO KAPITAL FUND A | ✓ | - |

Sustainability risk policy

The risk management process in general |

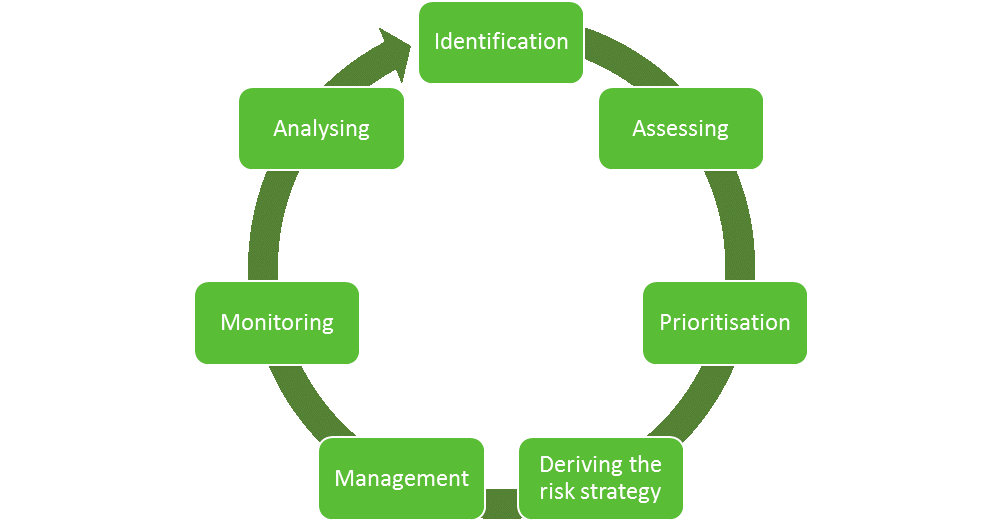

The fund management company has implemented a standardised process that systematically identifies, assesses, evaluates, controls, and continuously monitors risks at the fund level. The identified risks are systematically recorded and documented. An assessment is made for each of the identified risks including sustainability risks and for each risk a risk strategy is derived. The risk management process is carried out on a regular basis. The periodic risk management process consists of the following steps: |

Risk identification comprises the early identification and recording of risks and is based on an indepth analysis of the fund structure, its assets and liabilities, the processes and the parties involved, geographical regions in which the AIF operates, and so forth.

Each identified risk is assess and classified in accordance with the probability of occurrence of a loss and the severity of a potential loss. In order to do so, qualitative and quantitative methods are applied, like scenario analysis and simulations, Value at Risk models, sensitivity analysis, etc.

The priority of the risks and the risk strategy are derived from the risk assessment. The risk strategy can take the form of:

• risk avoidance (e.g. hedging, insurance),

• risk reduction (e.g. cash flow matching, duration matching, derisking and divesting, etc.),

• risk taking.

In the management process, the specific strategy (e.g. buying a hedge, duration matching of assets and liabilities, etc.) is applied considering the associated costs and benefits. Subsequently, the remaining risk is monitored and analysed.

More details about the internal control system can be found here.

Sustainability risk |

| Sustainability risk means an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment. We distinguish between physical and transitional sustainability risks. Physical sustainability risks arise directly from the consequences of climate change, social interaction or poor corporate governance, such as • extreme weather events, floods, heat/drought, storms, hail, • pandemics, • damage caused by inadequate product safety, • etc. Transition risks are risks that arise from the transition to a climate neutral and resilient economy and society causing a devaluation of assets, such as: • changes in political and legal framework • technological developments and • changes in consumer behaviour. |

Consideration of sustainability risks in the investment process |

| The risk potential from sustainability risks for the funds managed by BFLI depends on the sensitivity of the assets to sustainability risks. These risks are to be identified, assessed and managed as part of the risk management process. The findings obtained are to be taken into account in the investment process. In most cases, sustainability risks are not modeled as separate risk type, but are considered within existing risk categories, as they have an impact on existing risk types. For example, extreme weather events and natural catastrophes might • increase price volatility. • cause defaults or reduce the value of collateral. • might lead to unexpected redemption requests and hence liquidity risk. |